Billing durable medical equipment (DME) to Medicare is one of the most technical and compliance-sensitive areas of the healthcare revenue cycle. In 2026, DME Medicare billing continues to evolve through policy updates, new documentation rules, stricter claim standards, and advanced billing technology expectations. For suppliers and billers, mastering the billing dme to medicare process is essential for optimizing reimbursement, maintaining compliance, and minimizing claim denials.

This extensive guide covers everything you need to know about the Medicare DME billing guidelines in 2026 — from coverage basics and documentation requirements to coding, claim submission, compliance risks, and how modern Medicare DME billing software like NikoHealth can support your operations.

Enrollment and Supplier Requirements

Before a supplier can bill Medicare for DME, there are several critical enrollment and compliance steps that must be completed. Medicare takes supplier oversight seriously to ensure that only qualified and compliant providers are reimbursed. Proper enrollment not only protects patients but also safeguards suppliers from costly denials, audits, and potential penalties.

To participate in Medicare DME billing, a supplier must:

- Enroll in Medicare and receive a supplier number: This unique identifier allows the supplier to submit claims and receive reimbursement for covered DME items. The enrollment process involves a thorough application and verification of the supplier’s legitimacy.

- Maintain current accreditation from a CMS-approved accrediting body: Accreditation ensures that the supplier meets federal quality, safety, and operational standards, which is a legal requirement for billing DMEPOS items.

- Hold a valid surety bond and comply with operational standards: Bonds protect Medicare in case of improper billing or fraud, while operational standards cover everything from proper storage of equipment to staff training.

- Meet Medicare DMEPOS supplier standards: This includes having a physical facility, trained staff, inventory control processes, and robust documentation practices that can withstand audits.

In 2026, CMS has placed even greater emphasis on annual reaccreditation, requiring suppliers to consistently demonstrate compliance with all DMEPOS standards.

This ensures that only suppliers meeting up-to-date clinical, operational, and documentation requirements remain eligible to bill Medicare.

Medical Necessity and Prescriptions

Medical necessity is the cornerstone of all Medicare DME billing requirements. Medicare will only reimburse for durable medical equipment if there is clear, documented evidence that the item was prescribed to treat or manage a specific medical condition. Proper documentation demonstrating medical necessity not only ensures timely reimbursement but also helps protect suppliers from audits and denials.

Standard Written Orders (SWOs)

In 2026, Medicare requires a Standard Written Order (SWO) for each DME item being billed. The SWO replaces older forms such as Certificates of Medical Necessity (CMNs) and Delivery/Installation Forms (DIFs), though a complete SWO must still be supported by the patient’s clinical records to avoid claim denials.

An SWO must contain all essential elements, including patient identification, item specifics, and prescriber information. The table below summarizes the required components:

SWO Component | Description | Notes |

Beneficiary Name / Medicare ID | Full patient name or Medicare Beneficiary Identifier (MBI) | Must match Medicare records |

Prescribing Clinician Name / NPI | Full name and National Provider Identifier of the ordering provider | Ensures accountability and traceability |

Item Description / HCPCS Code | Specific description of the DME and the correct HCPCS Level II code | Use current codes; incorrect coding is a top reason for claim denials |

Brand / Model Information | When applicable, specify brand or model | Required for items with variable pricing or features, e.g., power mobility devices |

Date of Order | The date the order was written | Often required before delivery for complex or high-cost equipment |

Clinician Signature | Electronic or written signature of the prescribing provider | Confirms medical necessity and authorization |

Updated Documentation Policies

Medicare’s recent policy updates emphasize flexibility in how prescriptions are documented. Certain elements of the SWO, when included in the patient’s medical record, can now be considered part of the documentation of medical necessity. This change reduces administrative burden while still requiring robust clinical justification.

Suppliers should ensure that every SWO aligns with the patient’s clinical record, including:

Relevant diagnoses or medical conditions

Functional limitations or impairments

Treatment goals for the prescribed equipment

Supporting notes from face-to-face evaluations

By following these standards, suppliers not only satisfy medicare guidelines for DME billing but also minimize the risk of claim denials and audits.

Coding and Modifiers: What Billers Need to Know

Accurate coding is another cornerstone of effective dme billing medicare processes:

HCPCS Level II Codes are used to identify specific DME items on claims.

Modifiers may be required to indicate rental vs. purchase, delivery conditions, or specific circumstances.

ICD-10 diagnosis codes must support the medical necessity of the equipment.

New and revised HCPCS codes for DMEPOS items are frequently released — including updates relevant to 2025 and 2026 — and billers must stay current with these changes. Using outdated codes is one of the most common reasons Medicare denies DME claims.

Medicare DME Claims Submission

Once eligibility and documentation are in order, claims for medicare dme billing guidelines fall under structured requirements:

Electronic Submission

Most claims are submitted electronically via Electronic Data Interchange (EDI) to the appropriate DME Medicare Administrative Contractor (MAC) jurisdiction. Each claim must include:

Correct HCPCS codes

Supporting documentation references

Necessary modifiers

Patient and supplier information

SWO details

Timeliness Requirements

Medicare enforces strict timeliness rules for claim submission, and late claims may be automatically denied.

Specific Situations

Items billed under “capped rental” categories follow strict guidelines on billing frequency and anniversary dates, and separate billing rules apply for equipment furnished during Part A stays.

Common Reasons DME Claims Get Denied

Denials hurt revenue and resource efficiency. In 2026, the top reasons for DME claim denials include:

Incorrect or missing SWOs: If the Standard Written Order is incomplete, missing key patient or prescriber information, or absent altogether, Medicare will reject the claim. For complex equipment such as power mobility devices or ventilators, pre-delivery SWOs are strictly required.

Incomplete documentation of medical necessity: Medicare requires clear clinical evidence supporting the need for DME. Missing functional assessments, diagnosis codes, or supporting clinical notes often result in denials.

Invalid or outdated HCPCS codes: Using obsolete or incorrect HCPCS codes is a leading cause of rejected claims. Suppliers must regularly update their code sets to align with the latest Medicare updates.

Missing or incorrect modifiers: Modifiers convey critical details about the claim, such as rental vs. purchase, special circumstances, or multiple item orders. Incorrect use can trigger automatic denials.

Claims submitted past timely filing deadlines: Medicare enforces strict submission timelines. Claims filed late may be denied outright unless a valid exception applies.

Non-participating suppliers not accepting assignment: Suppliers who are not enrolled as participating providers and fail to accept assignment may encounter reimbursement issues, including reduced payment rates or outright denials.

In addition to these, other factors such as inconsistent patient identifiers, mismatched prescriber information, or incomplete delivery and follow-up documentation can further increase denial risk.

Strategies to Reduce Denials

In modern DME Medicare billing, automated denial prevention and clean claims practices are essential. Suppliers can significantly reduce risk by:

- Implementing automated claim scrubbing tools to catch errors before submission.

- Conducting pre-billing audits to verify SWOs, HCPCS codes, and clinical documentation.

- Keeping HCPCS and modifier data current with Medicare updates.

- Providing ongoing staff training on updated guidelines and documentation requirements.

Using real-time eligibility and claims validation software to ensure compliance with Medicare rules.

Medicare Audits and Compliance Oversight

Medicare DME suppliers are among the most heavily audited provider types due to the high risk of fraud, improper billing, and documentation errors in the DME sector. In 2026, CMS continues to strengthen oversight, and audits have become more comprehensive and technology-driven. Suppliers must understand the audit process and proactively maintain compliance to protect revenue and program eligibility.

Key Compliance Triggers

Audits are often triggered by patterns that indicate potential errors or abuse. Some of the most common compliance triggers include:

- High denial rates: Frequent claim rejections signal to Medicare that a supplier may be submitting incomplete or inaccurate claims, prompting closer scrutiny.

- Suspicious claim patterns: Claims that show unusual billing frequency, unusually high-cost equipment, or multiple claims for the same item can attract audit attention.

- Improper documentation: Missing SWOs, incomplete clinical notes, or inadequate evidence of medical necessity are leading causes of audit findings.

- Missing or inaccurate orders: Claims without valid Standard Written Orders or with mismatched patient or prescriber information are flagged immediately.

- Rapid changes in billing behavior: Sudden increases in claims volume, new HCPCS codes, or billing multiple high-cost items can also trigger compliance reviews.

Preparing for and Managing Audits

Suppliers must maintain detailed, organized records of all claims, orders, and supporting documentation. This includes SWOs, clinical records, delivery confirmations, rental logs, and any communication with patients or prescribers. Medicare auditors may request documents from months or even years prior, so retention policies and secure record-keeping systems are critical.

Failure to produce adequate records during an audit can lead to serious consequences, including:

- Claim recoupments — Medicare may demand repayment of previously reimbursed funds.

- Civil or financial penalties — Non-compliance can trigger fines or sanctions.

- Exclusion from the Medicare program — In extreme cases, suppliers may lose their ability to bill Medicare entirely.

Technology Tools for DME Billing Success

The complexity of DME billing, combined with stringent Medicare DME billing requirements, means that manual processes are prone to errors, denials, and compliance risks. Modern technology tools help suppliers automate critical tasks, reduce human error, and maintain a clean, audit-ready billing process.

Dedicated software solutions provide a range of essential features, including:

Eligibility Verification: Automated verification ensures that a patient is eligible for Medicare coverage and that the DME item is covered under their plan before the claim is submitted. This step helps avoid costly denials due to ineligible patients or non-covered items.

Claim Scrubbing and Validation: Advanced claim scrubbing tools automatically check for missing information, mismatched SWOs, incorrect HCPCS codes, and required modifiers, significantly reducing rejected or denied claims.

HCPCS and Modifier Accuracy: Maintaining accurate codes is one of the most common challenges in dme billing Medicare. Software helps suppliers stay current with updates, ensuring claims comply with the latest CMS coding requirements.

Real-Time Denial Alerts: Some systems flag potential issues immediately, allowing staff to correct them before submission. Early detection prevents delays in reimbursement and avoids cascading problems caused by repeated rejections.

Audit-Ready Documentation: With integrated documentation management, software can store SWOs, clinical records, delivery confirmations, and patient communications in a secure, organized, and retrievable format. This ensures suppliers are always prepared for internal audits or CMS compliance reviews.

With rising expectations for clean claims and electronic submissions in 2026, suppliers who still rely on paper-based or manual processes face a higher risk of denials, delays, and compliance lapses. Automated technology is no longer just a convenience — it’s a strategic advantage for maximizing efficiency, reducing administrative burden, and ensuring compliance.

Best Practices for 2026 and Beyond

To thrive under the updated Medicare DME billing guidelines and evolving CMS rules, suppliers should adopt a proactive, technology-driven approach. Key best practices include:

Invest in Automation: Leveraging modern Medicare DME billing software reduces human error, speeds up claim submission, and ensures consistency across multiple billing staff and locations.

Keep Coding Current: HCPCS codes and modifiers are regularly updated. Subscribing to updates and reviewing bulletins ensures compliance and prevents denials due to outdated codes.

Train Staff Frequently: Billing staff must stay informed about medicare guidelines for DME billing, including medical necessity, documentation requirements, and new CMS rules. Continuous education helps prevent costly errors.

Standardize Documentation Workflows: Align SWOs, clinical records, and billing entries to create a seamless workflow. Standardization reduces the risk of missing or incomplete documentation, a common audit trigger.

Audit Internally: Simulate CMS audits to identify gaps before external reviewers do. Internal audits help suppliers address potential issues proactively.

Build Feedback Loops: Track claim denials, identify recurring issues, and refine processes over time. Using data-driven insights ensures continuous improvement in billing accuracy and compliance.

NikoHealth DME & HME Billing Software: Simplifying Compliance and Revenue Management

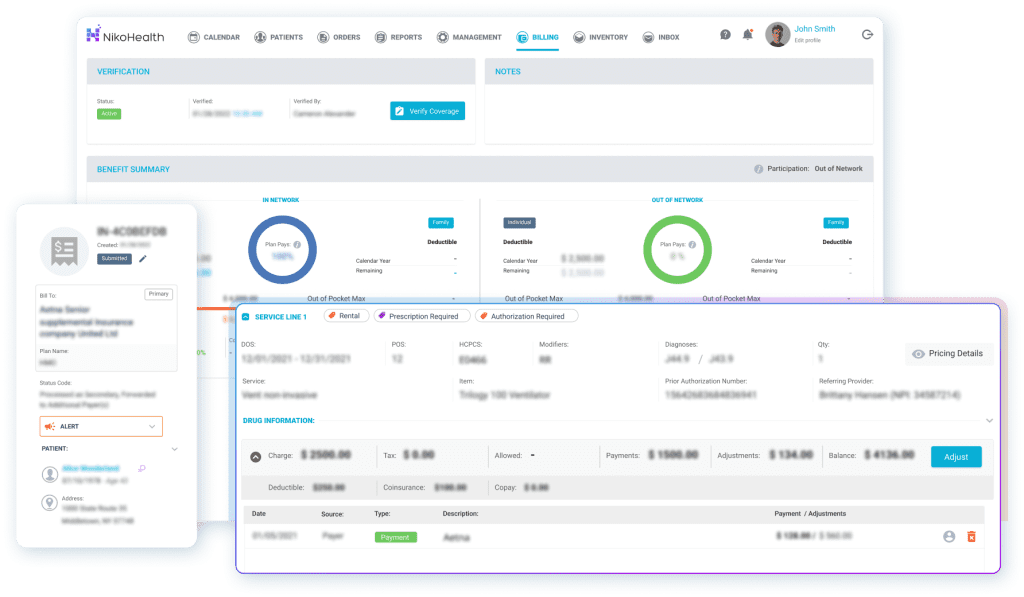

Managing Medicare DME billing requirements in 2026 is complex, with evolving documentation rules, coding updates, and compliance standards. NikoHealth’s HME/DME billing software provides an all-in-one, cloud-based solution designed for suppliers of any size — from small providers to high-volume operations. By combining advanced automation, intelligent claims management, and audit-ready reporting, NikoHealth empowers teams to streamline processes, reduce errors, and maximize revenue.

Key Features and Benefits

Automated Claim Scrubbing: Detect and correct errors before claims are submitted, reducing denials and resubmissions.

Real-Time Eligibility Verification: Instantly confirm patient coverage and benefits from Medicare and commercial payers, preventing delays and rejected claims.

HCPCS & Modifier Accuracy: Stay compliant with the latest coding updates and payer-specific rules, ensuring claims are clean and error-free.

Compliance Tracking: Monitor all documentation, Standard Written Orders (SWOs), and claims to meet Medicare DME billing guidelines.

Audit-Ready Reporting: Securely store clinical records, delivery confirmations, and claim histories for internal reviews or CMS audits.

Patient Collections & Automation: Streamline patient responsibility estimates, automate e-statements, and simplify payment collection both in-person and remotely.

Intelligent Workflow Management: Reduce repetitive tasks, eliminate human error, and focus staff efforts on strategic work instead of manual billing processes.

Mobile Access & Cloud SaaS: Access your billing platform securely from anywhere with SSO and two-factor authentication.

Related Articles